Orlando, FL

This Class A property is part of the Creative Village, a $700M public/ private project in the hearth of Orlando.

Frankforter Group is a third generation real estate investment and asset management company, specializing in acquiring institutional-quality multifamily and commercial real estate properties across Canada and the United States. Our team has over 40 years of managerial experience in CRE and a proven track record of delivering impressive returns to our investors. With $2.8 billion in transaction experience, we’re dedicated to helping our partners achieve their financial goals through sound real estate investment strategies.

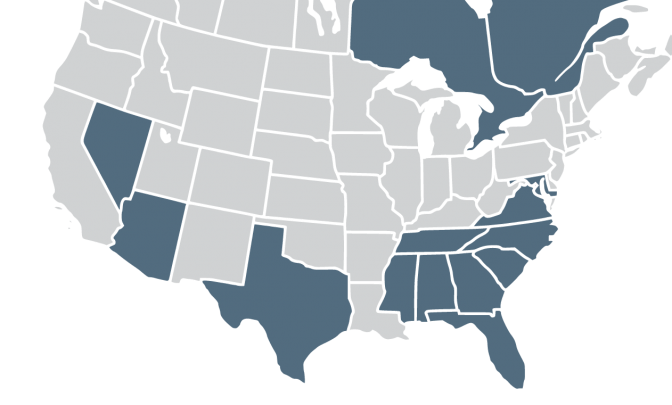

Our investment strategy is centered on income-producing multifamily residential properties that generate positive cash flows, as well as steady appreciation over time. We focus on properties located in a variety of Sunbelt states, including Florida, Georgia, North and South Carolina, Texas, Arizona, Virginia, Tennessee, Nevada, and Alabama. Our goal is to deliver superior risk-adjusted returns by investing in well-situated multifamily assets that have the potential to build equity value and generate stable cash flows for our investors. We also offer a range of investment vehicles across various real estate strategies for both our institutional and private partners. With our expert guidance, we ensure our partners can build significant equity while enjoying the benefits of passive income.

Each investment opportunity undergoes rigorous underwriting and stress testing to ensure that it meets our high standards for risk and return. We work with trusted third-party firms to conduct comprehensive financial, physical, and legal due diligence that drives value in our real estate investment decisions.

Frankforter Group aims to maximize low-risk adjusted returns by investing in the best-in-class assets with positive cash flows. Our fundamental value approach is focused on identifying undervalued assets with strong potential for growth and long-term success.

Given the experience of Frankforter Group’s team, we continue to build broad-based, substantive industry relationships with the nation’s top advisors, agents, operating partners, investors, and lenders, thus ensuring that our investors enjoy unparalleled opportunities.

Asset management means providing active leadership throughout the investment lifecycle. We focus on market trends to guide each investment, including operating strategy, capital improvements, and budget reports, with the primary goal of maximizing revenues, ancillary income and overall returns for our investors. In addition to delivering strong results for our partners, we are incredibly proud of the meaningful positive impact we have on the tenant communities in which we serve.

Our tailored reporting procedures guarantee transparency and timeliness, ensuring that investors receive accurate and up-to-date information promptly. With a dedicated team of IR professionals, we prioritize clear and comprehensive reporting, keeping our investors informed every step of the way.

Frankforter Group boasts a team of seasoned professionals with extensive experience and expertise in the real estate industry. Led by visionary leaders, our team’s deep understanding of market dynamics and strategic insights guide our investment decisions, ensuring exceptional outcomes for our investors.

Each investment undergoes an extensive underwriting and due diligence process, through an in-depth market research and financial, physical and legal audit, that fosters our decision making. We have a proven track record in recognizing opportunities in the market. Frankforter Group asset management team works in collaboration with the property management professionals to maximize investments returns.

This Class A property is part of the Creative Village, a $700M public/ private project in the hearth of Orlando.

The property is located in the historic Collier Heights neighborhood. Built in 1971, this community has received an extensive renovation plan.

This 2019 mid-rise property represents one of the classiest communities in the Pompano Beach sub-market.

An upscale waterfront community with easy access to Pinellas and Hillsborough counties.

A Class-A high rise newly-built property located in Downtown Atlanta.

An intimate and vibrant community nestled between the University Mall and the University of South Florida.

This Class-A property is located right in the Health Village, a medical private/public project in Downtown Orlando.

A garden-style community conveniently located in the fast-growing suburb of Hoover.

The property sits close to the Texas Medical Center, the largest healthcare facility in the world.

This property has been built in the mid-’90s and it’s conveniently located between the Hines Mall and Downtown.

A 2017-built luxury class-A apartment community located in the Broward County.

A 29-acre garden-style property located a few miles south of the Hartsfield–Jackson Atlanta International Airport.

This mid 80’s property is located within a short drive from the University of South Florida.

A garden-style property in Fulton County, 5 miles southwest of Downtown Atlanta.

At Frankforter Group, we pride ourselves on our rigorous investment process, which includes extensive underwriting and due diligence. Our in-depth market research and comprehensive financial, physical, and legal audits help inform our decisions and ensure that we only invest in opportunities with a clear path for success.

![Building Hi new res[42]](https://frankfortergroup.com/wp-content/uploads/2023/05/Building-Hi-new-res42-3.jpg)

With a rich depth of expertise and extensive experience in the real estate industry, Frankforter Group has consistently demonstrated effective revenue management since its establishment.

Through our Core+ strategy, we aim to capitalize on the favorable demographic trends and historically low vacancy rates present in regions experiencing compelling population & employment growth and lifestyle preferences. Our plan is to purchase recently-constructed properties and actively manage them to bring out their full potential, including driving net operating income through the optimization of rental rates and other revenue-generating activities, as well as the implementation of cost-effective operational procedures.

As a trusted partner for investors seeking reliable investment opportunities, our track record of success is a testament to our unwavering commitment to excellence.

Through our Value-Add strategy, we aim to acquire under-performing, well-situated assets, combined with an active asset management approach utilizing reputable, best-in-class property managers. Through our expert guidance, property management partners help implement net operating income growth by maximizing rental rates, occupancies and ancillary revenue opportunities, combined with rigorous operational controls to reduce and maintain lower expenses.